If you are tired of the standard debt advice (cut expenses; live like a monk), you’re in luck . . . . . .because today I’m going to share a huge practical list of the absolute best ways to get out of debt.

I’ve worked in the financial world for 20+ years and my company has helped thousands of Canadian families and businesses get out of millions of dollars of debt.

My name is Paul Murphy, by the way.

These tactics are based on what I’ve seen work over the years from working with hundreds of families, individuals, and businesses.

None of these links or recommendations are affiliate links or paid promotions. These are just resources, debt reduction tactics, and things we’ve found to work.

Chapter 1: Is this advice for you?

In this post, you’ll get tons of ideas for getting out of debt. I cover practical lessons, debt calculators, online financial literacy workshops, videos from experts, and debt worksheets.

This post, though, is designed for people on the road to financial recovery.

We’ve written other articles for those of you drowning in debt. If you are 30K and above in debt, we recommend that you read this debt guide or take a look at our resource on bankruptcy alternatives.

Those posts are more suited to families and individuals carrying large amounts of unsecured debt.

But let’s begin with the 3 different methods for getting out of debt. The goal is to find the type of advice that works best with your personality and lifestyle.

The three types of debt reduction advice

In general, debt reduction techniques can be broken in three camps.

The first is frugality. Blogs like Mr. Money Moustache focus on reducing the money going out. This involves things like being militant about spending, searching for deals and coupons, and breaking away from the conventional money traps in our culture.

Do you have the disciple to be frugal? If you don’t, then there are different paths out of debt.

The second type of advice involves earning more. Blogs like I Will Teach You to Be Rich focus on increasing the amount of money coming into your bank every month.

This might seem daunting for some people but it involves a different mindset. For example, instead of saving your money and skipping a vacation, you could go camping and rent your home on Airbnb, using the profit towards debt reduction.

Or get a second job on the weekends to put directly towards your debt, rather than skimping on coffee.

The important thing to remember is that you really need to be honest about your personality.

I’m more in the second camp. I’d rather work Saturdays and look for part-time earning opportunities (such as boarding dogs or picking up extra seasonal retail work at Christmas) than extreme frugality.

Other people, value their free time. So, they’d rather practice extreme saving habits all week so that they can spend Saturday in the park with their family. There is no right answer.

But you should pick a method that works for you (we cover different tactics below). The final camp offers a hybrid. Authors like Gail Vaz-Oxlade tend to recommend both ruthless financial pruning and additional earning.

This can work but you need to be careful about fatigue. Banning eating out can work for a few months but if going out for a date night with your partner is what makes you feel fulfilled, it’s easy to fall back into old habits.

This is why you want to choose the method that fits the type of life you want to live.

Chapter 2: Debt calculators & tools

Debt calculators are useful to start planning your method of attack. They help you see the reality of your situation.

Here are a few we always recommend to the people we help out of debt.

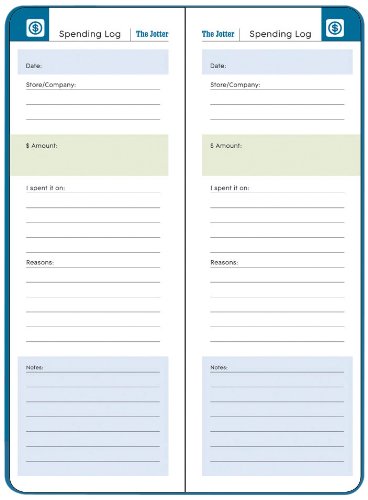

- Very useful interactive debt worksheet (pictured above)

- Excellent Budget Calculator Interactive Budget Calculator (via the Canadian Government)

- Credit Card Calculator (via the Canadian Government)

- Financial Goal CalculatorRetirement calculator from Tangerine

Workshops & tools for financial literacy

If you are in debt, you need to invest in a bit of financial education. Here are a few workshops, videos, and more advanced resources for understanding and getting out of debt.

- Really helpful financial workshops with videos and resources (Workshop + Videos)

- Get Smarter About Money (Resources by the Ontario Government)

- Tax-Free Savings Account My Money My Choices by Gail Vaz-Oxlade (financial literacy course)

- Registered Retirement Savings Plan via Canada Revenue Agency

The best books for getting out of debt

Here are the best books for navigating debt and putting a solid plan in place.

We’ve included a lot of information and debt reduction strategies below, so keep reading this article before you spend too much at Amazon.

- Beginner’s Guide to Personal Finance Debt-Free Forever by Gail Vaz-Oxlade

- How to Pay Less and Save More For Yourself by Rob Carrick

- It’s Your Money by Gail Vaz-Oxlade Money Rules by Gail Vaz-Oxlade

- Stop Over-Thinking Your Money! by Preet Banerjee

- The Soul of Money by Lynne Twist

- Total Money Makeover by Dave Ramseys

Chapter 3: the emotion of debt

Cut ruthlessly on things you don’t love

My friend loves to buy lunch during the week. He is good with his money and can afford it.

For example, he doesn’t eat out on the weekends. So buying lunch everyday is his guilty pleasure and helps to make work more enjoyable.

I love travelling. I really don’t care about eating out for lunch. I feel that I can make just as good food at home. So, I put the money I would have spent on lunch towards my vacation fund.

The point is that to get out of debt you need to develop long-term financial habits.

The key is to ruthlessly cut expenses you don’t care about and to allow yourself some freedom for the things you love.

Do you buy breakfast at the coffee shop because you love the ritual? Or do you do it because you wake up late everyday and never have time to grab something from home?

Do you buy wine from the expensive beer and wine store by your house because you love their selection and the neighborhood walk? Or because you don’t feel like driving to the cheaper liquor store?

Take Action!

Do an audit of what you spend your money on. Look for basic items to cut forever from your spending.

This gives you more money to put towards debt and more freedom to indulge occasionally on the things you love. I did this audit and saved myself hundreds of dollars every year on things I really don’t care about.

Here’s what I found I could cut from my spending:

- Coffee shops: I like waking up early and having it in my house. I buy good organic coffee and so I prefer to wake up early and have it at my computer rather than getting it to go.

- Wine: I can buy it cheaper in bulk and store in my house rather than spending money at the beer and wine store.

- Lunch: I really don’t care about it. I bring lunch to work and save about $50 per week.

- The right grocery store. I used to shop at the one closest to my house. It’s expensive and everyone knows it. An analysis found that it was about 15% more expensive than the larger chain grocery stores. That is a ton of money every year just for convenience.

Keep your debt repayment rolling

After you have paid off one debt, keep the momentum going. This is what Dave Ramsey calls the “debt snowball” effect.

It involves understanding that debt repayment is psychological. Resist the temptation to celebrate paying down a big debt as an excuse to take a break.

Stay focused on eliminating the next one! I can remember when I had a student loan. God! I hated paying off this debt. Even after I had paid down my credit card and had extra money, I hated paying down this debt.

This, of course, was pure emotional thinking. Debt is debt and while student loan debt accumulates interest slower than consumer debt, it still eats your money.

Stop emotionally categorizing debt

Humans have a strange ability to compartmentalize the world.

We’re fine paying down debt with our salary, but when we get a bonus at work we feel that it should be used for something fun.

A good example of this is the categorization of good debt versus bad debt, even though the net result is that debt generally keeps us broke and prevents us from putting our money to work for us.

Take Action!

It’s important to notice your emotional drivers when it comes to debt.

Things like mortgages, student loans, spousal debt, and bankruptcy have a lot of emotional power and often-fuzzy reasoning.

For example, you buy a home to invest in your future. If this investment is crippling your financial life and sinking you into debt—what are you doing?

Stop hating your future self

When you keep debt for a long period of time to achieve freedom now (I don’t want to pay debt now, I need to enjoy life), you rob yourself of future freedom.

You can delay your retirement. Or lose out on an opportunity to get ahead. One business I worked for went through a slow period. They borrowed money from the bank to pay me and the other employees.

They were willing to borrow more to stay afloat. Another business I worked at went through a similar period of hardship. Instead of borrowing money from the bank, the owners dipped into their personal savings to make payroll.

It was harder to do and risky. But it kept their business free of debt. The point is that some people will try harder than others to avoid debt and will avoid it at all costs.

In general, it’s better to suffer to avoid debt than suffer the long consequences of borrowing during a time of crisis.

Take Action!

It shows that we should learn to hate debt more.

Not just to hate paying interest or hate being broke. But to hate the concept of debt as it takes our freedom.

Think of buying as investing

“Business and financial planning are exactly the same,” says Arlene Dickinson, CEO of Venture Communications and co-star of “Dragon’s Den.”

“You have to ensure you are putting your dollars to the right use and that you’re investing in areas with the most reward and potential.”

This really rings true with big purchases. Think carefully about tying up your money.

For example, when I put a down payment on my home, my mortgage broker told us to take $5,000 from the payment to pay off our car.

This saved us about $500 in interest and freed up our cash flow. With less consumer debt, we could get a better mortgage rate and could put that new money to a better use.

Take Action!

Think strategically about how you spend your money.

And be guided by a simple principle: how can I avoid paying less interest?

Chapter 4: budgeting & spending

Use ReadyForZero

Ready for Zero is an online tool that helps you manage and reduce your debt.

It helps you track the different interest rates of your loans, gives you payment reminders, and helps you set debt reduction goals.

I love it! It can really help to bring your debt reduction goals into focus.

Use this amazing online mortgage calculator

The government of Canada has a great mortgage calculator available online.

Don’t forget to play around with prepayments as they can result in huge savings.

I cover prepayments and how to pay down your mortgage faster in the last section of this article.

Practice planned spending

The road to debt is paved with the best intentions to never spend any money ….EVER!

No dinner out. Rice and beans every night. Brown bag lunches. Zero entertainment budget until the vacation on the credit card is repaid.

How often does this work?

If you are like me, living like a monk and working all the time isn’t much fun. And so, you slip into old habits and the spending continues.

A better strategy is to sit down at the beginning of the month and plan the purchases that you will make. I call these “planned purchases.”

You can allow yourself a certain number of flexible credits. For example, this month we have these credits we can use:

- 4 fancy coffees while out on Saturday walks

- 1 pizza night

- One night at the movies

- 1 happy hour with work

Impulse purchases happen at emotional times.

For example, you don’t plan to order take-out but then after a 12-hour day at work and an empty fridge, it just happens. Or you don’t plan to go out for drinks but then a friend texts you and you instinctively say yes.

By planning these purchases, you can better control your spending, still enjoy a bit of your life while paying down debt, and better budget for your “wants.”

Take Action!

Make a list of planned purchases.

Grant yourself some indulgences based on past impulse purchases. I recommend using a small kitchen whiteboard.

Once you’ve used up a credit (like ordering take-out), mark it down.

This system is much easier than opening a spreadsheet and entering a purchase every time you buy lunch at work.

Analyze convenience, especially packages

In North America, whenever something is convenient, you will pay a premium for it.

To reduce debt, you need to learn to recognize convenience and then reinvest the savings into paying down debt.

For example, I recently switched smartphone plans and was given two options. Pay nothing for the phone and get a higher monthly bill. Pay $200 on the spot and get a lower monthly bill.

Most people choose the first one. But that $200 I paid upfront saved me $540 over a two-year period.

Recognize these traps and avoid them. The more money you save for your future self (such as having a $10 lower monthly bill), the easier it is to climb from the pit of debt.

Track your spending for three months

I very much like Gail Vaz-Oxlade’s method of making couples track their spending.

One of the ways we get deep into debt is simply not knowing where exactly the money goes.

Again, it comes back to input versus output. So the first and necessary step to getting out of debt is understanding your spending over a three-month period.

This lets you normalize your income versus debt and get a true picture of what’s going on.

There are three steps. First, track forward for at least three months using a Spending Journal. Next, conduct a Spending Analysis, studying the different categories (such as wants versus needs) and places you are bleeding money.

And finally, you can create your budget based on this work. You can do all this manually with a piece of paper and a spreadsheet. You can also purchase for $5 Gail’s Spending Analysis package.

It includes her basic system and is worth the money, as it will save you some time.

Take Action!

Get Gail’s Spending Analysis package to help you track your spending and create a budget.

Buy YNAB’s budgeting software

I tried Mint.com to manage my budget but I found that the failure of Mint’s software is that it is an analytics program.

Analytics shows you “what happened.” So by the time you find out where your money went it’s a bit too late.

It’s hard to change your behaviour based on what you’ve done in the past.

I recently started using YNAB’s budgeting software. It’s fantastic and a good tool to use.

Unlike Mint, it is designed to change your behaviour and help you proactively budget instead of worrying about past spending sins.

One of the core principles of YNAB is to help you slowly build enough money so that you can live on last month’s salary.

In fact, they outline 4 basic principles of money and debt in the video above. I really like their approach.

Their budgeting software helps you break the debt cycle, giving enough cash on hand to handle life’s unexpected emergencies.

I’ve learned from helping families survive financial crises is this: often a very minor expense (such as the car breaking down) is the straw that breaks the camel’s back.

A small emergency can lead to a debt domino: they fix the car, miss a mortgage payment, and then spiral beyond simple solutions like saving or cutting back.

Take Action!

Try out YNAB. You can get a free trial at YNAB.com. The software is pretty cheap to buy.

Audit all subscription payments

This is a minor but very effective way to get out of debt.

A few years ago, I took about two hours to look at all automatic and subscription payments. These are things like your Netflix subscription, that website domain you renew every year, your cable bill, and any other software or entertainment packages you buy on a monthly basis.

It seems minor but you would be surprised at how much you are paying on a yearly basis.

Subscription companies try to slip beneath the radar. This is why they charge $5 or $10 per month. They are in it for the long term: $10 for three years is $360.

Audit everything and cut ruthlessly. Put the money you save towards your debt. Lately, I’ve been noticing these subscription fees adding up again (I love buying software and online tools!) so I need to do another audit.

Take Action!

Spend an afternoon auditing automatic payments and subscriptions.

Cut anything you don’t use and call your bank if they are charging you a bunch of fees to see how they can help.

Use Mint.com to audit bank fees

While I don’t like Mint.com for tracking my spending, I do like that the software sends you an email every time a bank charges you a fee.

I always assumed that I never spent much on bank fees. According to Mint, last year I spent over $300 in personal banking fees!

Most of these were due to email money transfers that I use ($1.50 per transaction). Mint also lets you set-up basic budgets and then notifies you when you exceed spending for that category. This can be revealing.

For example, set a budget for bank fees (what you think you are paying) and Mint might surprise you.

Audit your bank fees and take action.

Either find a new bank or look for alternative solutions (for example, now I try to transfer money from PayPal as its free). It’s important to recognize a pattern. Small thoughtless spending is money wasted.

Schedule regular money reviews

Every month, you should sit down for about 15-20 minutes with your significant other.

The goal of the session is to answer one essential question: Are you spending more than you earn?

Review the month’s spending and compare that to your income.

If you can’t answer that question, you are really in trouble and need to work harder at your finances.

Face the ugly truth about interest

Gail Vaz-Oxlade has a great tool on her site that lets you calculate how long it will take to pay down your debt.

It lets you input your principle and interest rate.

The tool will then show you how long it would take to repay that debt based on different time periods and monthly payments.

Take Action!

Spend a few minutes facing the truth about how long it will take to pay down your debt with Gale’s debt worksheet tool.

Calculate how long your debt will take to repay.

Carry a money notebook

For a while I looked for cool apps and software to track my spending. But this is all just a distraction.

The thing that prevents most people from tracking their money isn’t a lack of technology. It’s a lack of making it a habit.

Every smartphone has a basic notebook. Create a page for each week and write down what you purchased immediately after buying it.

At the end of the week, review how your spending went. I like doing this on a weekly basis as it helps you reach your monthly goals.

A month is a long time and it can feel like you only bought lunch a few times at work when really you are spending $50 a week that could go to debt repayment.

Break the Debt Cycle by Planning Ahead

Start an emergency fund

It might seem counterintuitive but if you come into extra money (tax return, rebates, or some overtime pay), you should use that money to build an emergency fund first and then pay off your debt after that.

Saving while being in debt can seem impossible. Yet, debt is a cycle and unless you move to fix your cash flow problem you will always fall victim to high interest and the mercy of your creditors.

You need to save, even when in debt. Every family needs an emergency fund.

Begin with a very modest goal such as $500 and start by saving $50 per month. I know that it’s tough. But every penny you save is helping your future self and making your ability to deal with unexpected expenses easier.

In the video below, John and Jennifer Croft from our Calgary office explain a very important concept about debt management.

It’s a complete mistake to dedicate 100% of your cash flow to debt repayment. Instead, you need to make sure that your own needs are taken care of and that you are working towards building a solid financial foundation for your family, instead of just working for your creditors.

Take Action!

Set up an automatic savings account with Tangerine.

Even if you only contribute $20 per month, it’s the habit that counts. Start building your fund and don’t stop until you have at least 6 months of living expenses covered.

As John and Jennifer Croft pointed out in the above video, it might seem counterintuitive to not dump all your extra cash into debt repayment.

But if you cripple your cash flow and dedicate 100% of your money into debt repayment, you’ll be very vulnerable. You need a long-term solution to debt.

Don’t overpay your debts

As mentioned, you really need to rewire your financial thinking.

The fastest way to get and stay out of debt is to make sure that you are setting yourself up for the long-term. It’s important that you don’t overpay your debts — leave enough so you have enough for regular expenses too.

Building up a healthy emergency fund and improving your cash flow helps to break the cycle and gives you control over your finances.

Take Action!

Whenever you have extra amounts of cash, consider adding the money to your emergency fund rather than paying down debt.

It will give you peace of mind and a better foundation to change your finances in the long term.

Never pay a short-term expense with long-term money

If there was a golden rule for avoiding debt, this principle would be a contender.

I know! I know! It’s really hard not to touch that emergency fund or to drain your savings. But you have to be strong a find a different way to pay for short-term expenses.

Don’t pay off your credit card balance from the emergency account.

Don’t drain your savings when things get tough.

Don’t touch long-term money (your emergency fund and any retirement savings) and pretend it doesn’t exist.

Money is a habit.

And there will always be short-term expenses and periods when you spend more than you make. But if you always rob your savings, you will be perpetually setting yourself up for failure.

Reduce Your Interest & Consolidate Debt

How to consolidate your debt

It is incredible how little most Canadians know about debt consolidation.

You are completely foolish if you believe the PR that consolidation companies will rip you off or that the only way to get out of debt is to pay your creditors every penny you borrowed.

Like anything, there are scammy debt consolidation companies that will charge you upfront fees and rip you off. And there are ethical companies with an excellent track record.

It’s your responsibility to research your options and educate yourself about the debt industry.

If you are deep in trouble, debt consolidation or transferring your debts to a single lower interest credit card is a very sensible route.

Take Action!

Here is a guide to debt consolidation that every Canadian should read.

Get an expert to calculate the long-term impact of interest

The key to getting out of debt is to do the long-term financial analysis. How much will you pay in interest if you continue down your current path?

By focusing on the long-term, more options will appear. For example, it might be prudent to take out a line of credit on your home to pay down your credit card.

Or you might be wise to sell your home, rent for a few years, and then buy again once the debt is wiped. If you are thinking about debt consolidation (see the last tip), you should make sure that this just won’t lead to more debt.

For example, if you consolidate your debt and then continue to use your credit cards you could end up right back where you started.

Debt consolidation can reduce your interest but if you still have a cash flow problem you’ll just end back in debt.

Take Action!

I recommend speaking to an expert to see if you can consolidate your debts . . . and let them do long-term calculations.

They might advise you to sell an asset or other advanced techniques.

The best way to find an expert is to just do a Google search in your city.

You can see a list of our experts across Canada here.

Or request an informal assessment about how much debt you could restructure here.

Chapter 5: travel the frugal route

Meet the effective fiscal fast

This is my all-time favourite way to reduce debt.

A fiscal fast is a period that you freeze all spending. Yes, everything. Not even a dollar leaves the home. This excludes regular life expenses of course like your mortgage or electricity bill.

Here’s how it works.

Pick a time period. For example, 7 days. Make sure you’ve gone shopping for basic things like toothpaste and milk before the fiscal fast officially begins.

Now, here’s the fun part. At dinner or while driving the children to school, yell “I DECLARE A FISCAL FAST.”

For the period of 7 days, you can’t spend anything. Not a coffee, a carrot, or 25 cents for a gumball.

If you are deep in debt, fiscal fasts should be done regularly such as once per month.

They help you control your spending, freeze any money going out of the door, and give you more money to put towards debt reduction.

Use Gale’s magic jars

If you want to give yourself a fool-proof way to make sure that you stick to your budget, I recommend using Gale Vaz-Oxlade’s magic jars.

They help you make sure that you don’t exceed your grocery and entertainment budgets and easily track your spending over the week.

Take Action!

For the extra frugal people, I recommend that any extra money leftover in a jar you put immediately towards your debt.

Gale says that you are allowed to transfer money from one jar to another, but I’d put that extra money straight towards your debt.

Read how to use the Magic Jars here.

Buy a French press for work

It was a nice ritual. Around 2:00 PM, I left the office and walked to the coffee shop.

It started out a few times per week. And then became a daily habit. I did the math. $4 per day is $20 per week.

That means in a given year, I would spend $960 on coffee. Instead, I bought a portable French press and make coffee at work.

Only shop for groceries once a week

For years, I would stop at this terribly expensive yet convenient grocery store by my house.

It was so close that trips became more frequent, up to 3 times per week.

Find the best and cheapest grocery store you can and shop for groceries only once a week.

Bring a list and try to plan your meals. The better food and meals you have at home, the less you’ll be tempted to eat out.

Eat before you leave the house

Protein bars and shakes are great for saving money at work as they can replace your lunch or breakfast.

They are also great for saving money from your entertainment budget. Before I go out for drinks with friends, I always eat a protein bar or have a shake.

This helps me avoid the temptation of buying a fatty dinner at the restaurant (I can just order a cheap appetizer to fit in) and keeps my restaurant bills low.

Chapter 6: increasing your income

Earn more … as simple as that

I know people hate to hear this. But if you are in debt, you need to earn more money.

Even $200 more per month can really help with debt repayment. This is the least used of all the techniques in debt reduction.

Take Action!

There are lots of options for earning extra money to put towards debt. Here are a few things I’ve done or heard about.

Board a dog at your home.

If you have a dog like I do, you can take care of people’s dogs while they go on vacation. I recently paid a dog sitter $350 to look after my dog while out of town. The same goes with cats. Just post your profile on Craigslist and spread the word through your friends.

Rent your house out on Airbnb.

I don’t like the idea of strangers in my house either. But Airbnb is very safe and you can vet the people that stay. If you are leaving town or going on a summer camping trip, this can generate some passive income.

Share your talents.

You can tutor, teach guitar, or give classes on your skill. I charged $30 per hour as a tutor and it’s a good job to do after work.

Get a part-time job in retail.

Working a few Saturdays every month can make a big difference.

Look for seasonal work.

I have a friend that makes over $25 per hour at Christmas time working casually for Canada Post. Every industry has their busy season and you can pick up some extra cash to pay down your debts.

Build an asset.

Sites like Skillshare.com let you teach courses to people. It’s a great platform and a lot of normal, ordinary people are making good money. Know Excel? People will pay for that. Are you a decent photographer?

People will pay to learn about basic techniques. Go browse some of their popular courses and then create your own. If you have a more advanced skill to teach, try Udemy.

Chapter 7: little known ways to get out of debt

Pick up the phone

One thing that people rarely do is to call their creditors. You would be surprised at how much money a single phone call can make.

Call your lender

I used to pay my student loan payments every month. It was how the default setting was created and the lender pulled it from my account automatically.

Then one day, I called the lender. “Can I pay bi-weekly instead of every month?” I knew you could do this with your mortgage, but had never been offered it with your student loan.

The answer was yes. That simple call saved me thousands of dollars in interest and got me out of debt faster.

Yet, millions of other Canadians blindly pay their student loan at the end of month.

Call your credit card

Ask your credit card for a lower interest rate. If the first person you talk to can’t help you, ask to speak to their supervisor.

If they say no, tell them that you are going to transfer the amount to a new card. If you have a good record of paying on time, they may be willing to reduce your interest rate to keep your business.

Call your bank Call your bank and tell them you are sick of their fees. Then be quiet. They will help you. You can also ask them to refund NSF fees when a payment bounces.

Call your cable & smartphone provider

Tell them you want a lower rate. If they don’t budge and you don’t have a contract, tell them you are closing your account and moving to a competitor.

I did this and they didn’t budge. So I went with a competitor and went from paying $70 per month for my cellphone to $44 per month. I notice absolutely no difference in the coverage.

Over a five-year period, that call saved me $1560 on cellphone bills.

Chapter 8: mortgages & debt

Look for small overpayments

You should review your mortgage payments to see how much you are paying.

If you are kicking in an extra $30 per month and are at beginning of a 25-year mortgage, that extra money would be better spent on a high interest debt.

It’s always a good idea to pay off your mortgage faster but if you are paying 19% interest to a credit card you need to readjust your strategy.

Given that credit card debt takes much less time to pay down than a mortgage, you can switch back after your high interest debts have been dealt with (see my next tip).

Choose an accelerated payment frequency

If you have paid down your high interest debts, then you’ll want to start paying down your mortgage faster.

An accelerated weekly payment is a good way to go. Since you end up making an extra payment directly against your mortgage each year, you’ll save $70,003.63 in interest over a typical amortization period.

Shorten your amortization period

When you shorten your amortization period, you’ll have to come up with more money for each payment but in the long term you’ll pay less in interest.

If you shorten a 35-year amortization to 30 years, you’ll save $55,430.90 in interest. Go with a 25-year amortization and save $108,345.42.

This should only be done once you’ve wiped out your unsecured debt and credit cards.

Make a principal prepayment against your mortgage

Most mortgages allow you to make an annual prepayment each year. This means that every cent goes straight to your principle.

It can be an excellent use for your tax return or any unexpected bonuses. Even small prepayments can save you a lot of money in interest.

For example, if you contributed a $3,200 tax return to your mortgage each year you’d save $112,348.58 in interest on a 35-year mortgage.

Chapter 9: debt settlement & restructuring

Start with these helpful articles

People get professional opinions for investing tiny sums of money but when it comes to owing $50,000 they just plug along.

Did you know that there are legal, government sanctified, and completely helpful ways for people to restructure their debt?

Every Canadian has options. It’s your duty to speak to a professional and educate yourself.

So where to begin?

Well, if you are a do-it-yourself type person we’ve covered many of these debt reduction options in the following articles.

Debt consolidation versus a consumer proposal-what’s the difference?

The complete guide to debt consolidation

A guide to avoiding bankruptcy for Canadians

“I can’t make my student loan payments”–advice for those deep in education debt

Get a professional assessment of your debt situation

Your job is to educate yourself.

If you are carrying a large amount of debt, speak to a professional. You can find experts by searching in your city.

We also have offices across Canada, which you can talk to on the phone, email, or meet in-person.

What does an expert know that you don’t?

They will teach you about debt restructuring options such as debt consolidation, consumer proposals, informal proposals, and how to approach your creditors with a restructuring offer.

They will also be able to analyze the type of debt you carry and educate you on the right choice for you.

You can sometimes reduce your debt with restructuring. For others, bankruptcy might be the right choice.

Here’s a list of our offices in your city. Ontario

- Barrie office

- Belleville office

- Brampton office

- East Windsor office

- Etobicoke office

- Guelph office

- Hamilton office

- Kitchener office

- London office

- Markham office

- Mississauga office

- Newmarket office

- North York office

- Oshawa office

- Ottawa office

- Peterborough office

- Port Hope office

- West Windsor office

British Columbia

- Abbotsford

- Burnaby office

- Fraser Valley

- Kamloops office

- Kelowna

- Kootenays office

- Langley

- Nanaimo office

- North Vancouver

- Prince George office

- Richmond office

- Ridge Meadows office

- Surrey office

- Vancouver office

- Vernon office

- Victoria office (Langford)

- Victoria

- Victoria office (downtown)

Alberta

Manitoba

Saskatchewan

Quebec

And finally, here are real stories about debt from Canadians who survived their financial crisis.