This article explains how 4 Pillars is different from licensed insolvency trustees (previously known as bankruptcy trustees) and other debt consultants.

A lot of people in our Debt Bootcamp have been emailing me and asking questions about how 4 Pillars started and how 4 Pillars is different than licensed insolvency trustees and debt consultants.

So today I’m going to reveal everything! This is your backstage pass to our company, why we are different, and how the debt industry works in Canada.

Here’s the full story.

4 Pillars started by consulting for struggling businesses. We soon realized the effect a failed business had on the business owner. These owners faced stress and needed impartial financial advice.

Over the past 20 years, we’ve grown to service 50+ locations across Canada.

Our partners have also helped to spearhead financial literacy programs in Canada. You can read about our EmpowerU program, which was cited by the Government’s Financial Consumer Agency of Canada here.

But we didn’t begin with a huge investment. We grew organically because our empathetic approach with consumers dealing with debt works.

You can read more about me (Paul), Reg, and Troy here.

In the beginning, we helped struggling companies restructure their debt.

A lot of companies we worked with were beyond help and ended up closing.

In many cases, personal credit had been used to subsidize the business. So the owners were on the hook for this debt.

We watched a number of business owners try to navigate the debt industry on their own, many going through bankruptcy as it was the only option presented. We watched others struggle to understand the other options available. These owners were also unsure if the advice being given was genuine advice to help them—or if it was self-serving to earn a higher fee or greater return to the creditors.

The failure and shame of debt

As we began working for friends and struggling businesses, we formed a deep personal connection with these people. Losing their business was a devastating process. Now they stood to lose everything personally and fall into what they saw as the ultimate failure: personal bankruptcy.

There is so much debt in Canada. But so little transparency and education for people struggling.

Where is the education?

Where are the financial rehabilitation programs?

Where are the options for families, especially since debt is so easy to fall into?

Word spread about our debt knowledge

In 2002, 4 Pillars was founded. The goal was to better help Canadians navigate the debt industry.

At first, we ran the business from our homes.

I think it was these early experiences and the relationships that quickly developed with our clients that really shaped 4 Pillars philosophy.

Debt is such a huge part of Canadian life—but few people are educated about how it actually works.

Debt is the #1 reason why marriages break-up and businesses go bankrupt. It keeps millions of Canadians under a huge weight of anxiety.

Back then, we figured out that our knowledge about the financial world could really help people.

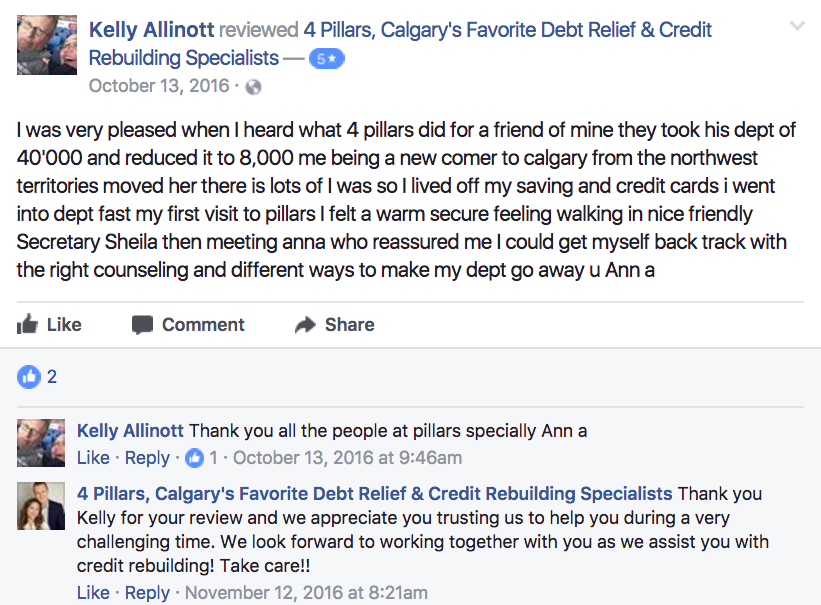

That’s why it’s rewarding to get reviews like this:

And like this:

And to meet people like this:

You can read hundreds of verified 4 Pillars reviews from TrustPilot (it is a site similar to Yelp which reviews service companies).

So how does 4 Pillars actually help?

How many choices do you feel you have right now?

In times of financial distress, our lives and businesses feel finished. We are ruined.

We give Canadians choices to deal with debt. We give Canadians education about dealing with debt. This means that people use our service once—and then never need it again. Not many businesses can say that.

Canadians simply don’t know what to do. They don’t understand what choices are out there, the legal methods you can take when you are struggling with debt, the informal methods and everything that needs to be done.

We give practical advice. And act as your advocates, helping you make decisions so you can choose the best option.

You have the right to look for other ways to solve your debt problems.

Bankruptcy or paying huge amounts of interest to creditors are not the only ways out of debt.

You have the right to be treated with respect and to not feel embarrassed by your debt.

And you can feel confident that this is only temporary. Many of the people we help go on to lead successful lives

Take one of those people. He was 50, facing bankruptcy, and about to lose his condo. You can read his 4 Pillars review, written in his words, here. He now has a new successful business and has put this time behind him.

In fact, he tells us that he “cringes when he reads his story,” as that world seems so far behind him now.

Here’s something really amazing. A few of our clients, who once struggled in debt, joined 4 Pillars. They now own their own 4 Pillars offices.

Their lives had been changed by the experience and they wanted to do the same for others. They were perfect advocates for the business, showing compassion for the debtor in a similar situation.

So do the solutions we offer actually work?

We helped families deal with hundreds of millions of dollars in debt last year.

97% of people entering our debtor assisted plans successfully complete the program which we believe is the highest in the industry.

We have a 9.4 rating from TrustPilot, with verified reviews from hundreds of Canadians we’ve recently helped. Read hundreds of 4 Pillars reviews here.

Many other companies only sell you a solution. They see your debt as a transaction. This means there is no pre and post-restructuring analysis, education or support.

We believe that you need support and guidance through the entire process. From helping you choose a plan to watching you get back on your feet, we’re there the entire way.

We want you to have long-term stability.

We love referrals from the past families we’ve helped but never want to see them again needing our services.

We want to get an email about your new life, new job or the new house you just bought—not you asking for help with debt again!

Nothing gives us greater satisfaction from our clients achieving this.

Why is credit rebuilding so important to 4 Pillars?

Credit building is another way that we are different.

You simply can’t move from debt restructuring to mainstream banking products without a transition period and a comprehensive credit rebuilding program.

If you don’t use credit rebuilding, you can suffer under bad credit for 8+ years with only access to short-term high-interest predatory lending products.

You become vulnerable to further financial challenges and pressures during this period.

Because of this there are over 1 million Canadians with bad credit and it is estimated that close to 25% of annual filings under the bankruptcy act are doing so for the second time within a 10 year period.

They aren’t given the tools to rebuild their credit and do not qualify for mainstream banking products. They lack the education to manage credit effectively.

The debt industry is very transactional with companies focused on dealing with debt and then moving on to the next client in line.

They don’t care about the impact that the program might have on your credit rating and how this will ultimately impact your financial stability and your ability to build wealth.

In the short term, you might feel some relief by dealing with the debt. But it will cause long lasting issues on their credit rating if that is the only step you take.

At 4 Pillars, we ensure that debt reduction is part of a long-term financial plan. As such, credit rebuilding is a critical piece to regain financial stability.

If you hit “contact your local office” at the end of this post, what happens next?

I’d like to go through what happens if you request a consultation with 4 Pillars. My goal is to help you see the exact process so that if you’re thinking of getting us to help you, you’ll understand our method for getting you out of debt.

If you decide right now to take that step and contact us, here’s exactly what will happen.

STEP ONE: Your initial consultation

You will receive an email or phone call from your local office (we have 60 offices across Canada). We do a complete review of your current situation.

You’re explained all the options available.

We explain the impact on credit rating, process, and timelines to implement the plan, and explain our fees.

While there is a fee, it is only optional after your debt restructuring plan is in place should you choose the full range of financial rehabilitation services. Don’t worry, we will explain how it helps you and then you can decide if its the right choice for you.

You provide Confidential Information Forms and get a list of all supporting documents required to move forward.

STEP TWO: Your second meeting

You provide your completed Confidential Information Forms and supporting documents.

STEP THREE: Your third meeting

You and your local 4 Pillars office communicate via phone and email on any arising issues or questions.

Your local 4 Pillars office analyzes the information and works on the most effective way for restructuring your debt.

If the most effective plan is a formal proposal to your creditors, then 4 Pillars helps you carefully select the best insolvency trustee.

Only licensed insolvency trustees can administer a consumer proposal—but the trustee you choose can make a huge difference. The selection we go through together is based on your unique situation and the differing interpretations of certain situations by the trustees.

We’ll help you ensure everything is working in your interests.

STEP FOUR: Implementing the plan

4 Pillars explains the process for signing the proposal and the assessment conducted by the trustee. We arrange the trustee meeting for you to sign the proposal papers.

We again review the trustees role and timelines after the proposal is submitted.

STEP FIVE: Submitting your documents

4 Pillars sends the file and all supporting documents to the selected trustee.

You along with 4 Pillars deals with the trustee regarding any issues or questions they have with the file

STEP SIX: Proposal signing with the trustee

You meet the trustee, the trustee goes through the assessment, your duties and their duties during the proposal and you sign the proposal documentation.

Trustee sends proposal package to the creditors.

Stay of Proceedings in place (you now have full legal protection from the creditors).

STEP SEVEN: Almost ready to put debt behind you

You and 4 Pillars communicates with the trustee and monitors votes throughout the process.

On the creditor acceptance of the proposal, you are notified by the trustee and 4 Pillars.

You make agreed proposal payments directly to the trustee.

4 Pillars sets up the next meeting for you to enter into a Financial Wellness Agreement for you to begin the aftercare program and start your journey to financial stability.

STEP EIGHT: Your new financial life begins

You are now given access to your post proposal credit report to beginning the credit rebuilding process.

The credit rebuilding program will run for the next 12-24 months with an ongoing monitoring of the credit report and score to ensure you are on track to achieve a 650 credit score.

Once credit is re-established, you will be given advice on how to maintain your credit score.

You can go back to enjoying your life and building a new financial future.

If you are ready to take the next step, we’ll put you in contact with your local 4 Pillars office.

Click here to book your first meeting

Not all consumers that contact us need debt restructuring and many resolve their debt issues by creating a manageable budget and a plan to pay down their debt. Many work with 4 Pillars on implementing the ‘snowball’ debt repayment method so they can maintain their credit score.

For those that have unmanageable debt, we believe the Bankruptcy and Insolvency Act offers the most effective solutions and deal with debt and also provides the best alternative to bankruptcy through a consumer proposal.

We also very strongly believe the debt industry evolves by providing consumer choice and complete transparency.

Here’s a little more detail about the bankruptcy and consumer proposal process.

A consumer proposal is a formal negotiation process between you and your creditors. It is a legal process governed by the Bankruptcy and Insolvency Act that must be filed by a licensed insolvency trustee (formally bankruptcy trustee). Licensees of 4 Pillars are not licensed insolvency trustees.

A consumer proposal comes with protection against most garnishments and legal judgments. It also prevents creditors from attempting to collect on any of the debt so those aggressive collection calls will stop.

The dual role of the trustee is to investigate the debtor’s financial situation, ensuring your rights are not abused while also protecting the rights of creditors.

The trustee can not act as an advocate for the debtor to get the best possible outcome from the proposal and act in the capacity of a ‘referee’.

The trustee fees are tariffed to continue on the theme of full transparency its important for you to understand the fees are based on receiving a percentage of what you pay back in a proposal or bankruptcy.

For consumers that have a strong understanding of the Bankruptcy and Insolvency Act and are not requiring comprehensive financial rehabilitation programs to reduce the impact on their credit rating working directly with a trustee can be a good option.

In this case, we recommend that at least three trustees are interviewed to understand the different interpretations of the BIA and how those may impact your situation before deciding how to move forward.

For those requiring their own independent advocate, additional support, compassion, and extended financial rehabilitation, then working with an intermediary like 4 Pillars can be an excellent option.

Consumer choice is what makes every industry strive to offer the very best service and the best solutions for the consumer.

At 4 Pillars we always strive to ensure the debt industry keeps moving forward and provides innovative debt and financial rehabilitation programs driven by the needs of the consumer and does not become driven by providing solutions that are creditor driven.

Take care of yourself and contact us if you have any questions.