Filing bankruptcy in Canada can be confusing. These 8 steps will make it simple and explain everything you need to know.

You probably already know the basics of bankruptcy in Canada. You know that it severely affects your credit rating. You may also know that you might get to keep a few assets (like your home).

But how do you actually file bankruptcy?

At 4 Pillars, we’re on a mission to make the debt industry in Canada simpler to understand and transparent. This guide will show you the exact steps you need to take to file bankruptcy in Canada.

This guide has three sections. You’ll learn:

- Applying for bankruptcy

- The actual bankruptcy process

- Life after bankruptcy

We’ll also cover some of the best alternatives to bankruptcy in Canada.

I’m Paul Murphy, by the way. I’ve worked in the financial services industry for 20+ years. I’ll explain the steps as simple as possible.

The basics of filing bankruptcy

STEP 1: First, find and hire a trustee. They administer the bankruptcy process.

STEP #2: Fill out the required forms given to you by the trustee. The trustee will help you complete these forms and file them with the Office of the Superintendent of Bankruptcy. You will then formally be declared bankrupt

STEP #3: Your non-exempt assets will be sold by the trustee. Some assets will be excluded. We cover these later.

STEP #4: Creditors will be notified that you are bankrupt. Your trustee will tell creditors on your behalf. You may be required to attend a meeting with creditors.

STEP #5: Begin financial rehabilitation. Once you file bankruptcy, you have certain duties to fulfill such as reporting income and submitting monthly expenses to your trustee. You will also attend financial counseling sessions. These obligations continue until you are formally “discharged” from bankruptcy (between nine and 21 months for first-time bankrupts).

STEP #6: Report all income and expenses. During bankruptcy, the government determines how much income your family needs to maintain a reasonable standard of living. You need to report expenses and submit pay stubs to your trustee. Any income that exceeds this amount during your bankruptcy is called “surplus income.” For example, if you get a raise or get a second job, you’ll need to pay a percentage of this “surplus” income to your trustee. The trustee will then distribute this income to your creditors.

STEP #7: You will be discharged from bankruptcy. This means you are released from the legal obligation to repay the debts you had as of the date you filed for bankruptcy. You won’t have all your debts clear. For example, you’ll still need to pay debts like alimony, child support, student loans (if you stopped being a student less than 7 years ago), court-ordered fines or penalties, or debts arising from fraud.

STEP #8: Attend a court hearing (if you don’t qualify for automatic discharge). If you do not qualify for an automatic discharge, you will need to apply to the court for a discharge hearing. The trustee will arrange this. You will usually need to attend this hearing in person and the court will decide whether to discharge you and which kind of discharge. These include (absolute, conditional, suspended, or none).

Make sense so far?

Let’s dig deeper into each step.

Meet the bankruptcy trustee

The trustee is an important part of filing bankruptcy. The trustee will deal with creditors on your behalf and handle the legal side of things.

It’s your job to find and select a bankruptcy trustee.

You can select the trustee you want to work with and although you will pay their fees you don’t really hire a trustee as they technically don’t work for you or represent you through the bankruptcy process.

The trustee does the following: administers the bankruptcy process; helps you complete the required forms; sells your assets and deals with creditors on your behalf.

Many Canadians seem to think that bankruptcy trustees are like defence lawyers or civil servants.

It’s true that they are licensed by the Office of the Superintendent of Bankruptcy (OSB). But they are independent businesses.

They advertise and need to find clients. You need to find and select your own (typically via a Google search).

They will also charge you an upfront fee.

As such, some are better than others and they view the bankruptcy insolvency act differently and this can have a dramatic impact on how your bankruptcy will play out.

We have a list of trustees across Canada that we’ve found to be fair, empathetic, and equitable. We are NOT bankruptcy trustees, so we are happy to share the ones we’ve found to be excellent.

What if I can’t afford to file bankruptcy?

Many Canadians begin thinking about filing bankruptcy. But soon they realize that the fees and loss of assets is a significant obstacle.

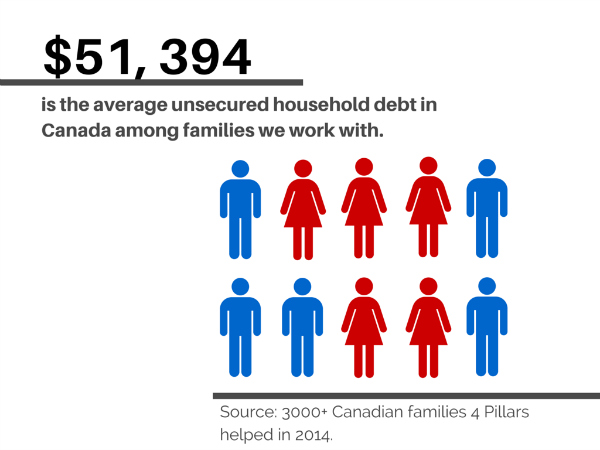

According to the Government of Canada’s study “Insolvency Statistics in Canada – November 2014,” bankruptcy is becoming a less popular option among Canadians.

Instead, Canadians are increasingly filing consumer proposals. Many Canadians are finding that consumer proposals are more cost effective. They allow you to keep your assets and have a lower impact on your credit rating.

Last year, the number of bankruptcy filings declined in Canada by 6.6%. In contrast, consumer proposals represented almost 50%of total insolvency filings in 2014. You can look at the national statistics on bankruptcy in Canada here.

- Almost 50% of all insolvency filings in 2014 used a consumer proposal instead of filing bankruptcy

- Consumer proposals often are seen as a much more flexible option

- Bankruptcy is declining in Canada with a 6.6% decrease in 2014

Bankruptcy trustees will charge you fees

“Most bankruptcy clients aren’t aware that there are three major costs associated with filing,” Stephanie Holmes-Winton, President & CEO of The Money Finder, told Yahoo Finance.

“These include a minimum contribution, a surplus income payment, and the money the individual will lose through non-exempt assets.”

Typically, the trustee charges you a minimum contribution each month towards the administrative charges associated with the bankruptcy filing.

After you file, you will automatically lose any non-exempt assets.

These can include:

- Contributions made to your children’s RESP’s

- Certain funds you’ve contributed to your RRSP and your tax refund

- Equity in your home or car

- Any “windfalls” that you may receive during bankruptcy such as inheritance, lottery winnings, or monetary gifts from family and friends

Key points about bankruptcy trustees

- The bankruptcy trustee handles all of the legal aspects of bankruptcy.

- Trustees do not work for the government, They are independent businesses. They charge fees and earn a profit from your bankruptcy.

- Ensure that you carefully select your trustee. We are not bankruptcy trustees and in our experience, some trustees are much more effective and empathetic than others.

Fill out the forms

So, you’ve selected a trustee. What happens now?

Once you’ve decided on a trustee and paid them their fees, they will do a few basic things for you.

They will help you complete the required forms. They will then file them with the Office of the Superintendent of Bankruptcy (OSB).

These forms are filed with the court. Once accepted by the court, you will be formally declared bankrupt. The trustee will now deal with creditors on your behalf.

Case study: How an Ontario family avoided bankruptcy

The family knew they were in financial trouble. Each month, their debt increased and both were under tremendous stress from losing work due to unexpected illnesses.

They considered bankruptcy and began researching their options online. After meeting with a bankruptcy trustee in Toronto, he recommended that they begin the process of filing bankruptcy.

While they knew they were in trouble, they couldn’t bring themselves to completely dismantle their lives with bankruptcy.

Here are the six steps they took to avoid filing bankruptcy in Ontario.

Your assets will be sold

Next, your assets will be reviewed and non exempt assets will be sold by the trustee. Some assets are exempted by provincial and federal laws (depending on little equity you have in your house, you may get to keep it).

The money raised from liquidating your assets will be put in a trust for your creditors.

Will you lose your house to bankruptcy?

Bankruptcies generally do not affect the rights of secured creditors. Mortgages are secured debts. This means that you won’t necessarily lose your home and if it is deemed that there is no equity in your home. If there is no equity in your home, you will be allowed to keep the home and continue to pay the mortgage.

However, if you have a poor payment history on your mortgage and the mortgage lender feels there is a highy possibility of future default the bankruptcy may allow them to take legal steps to take ownership of this asset.

It also varies by province. As an example, in Alberta, the first $40,000 in home equity is exempt.

Creditors will be notified

Shortly after signing the papers the trustee will tell your creditors that you are bankrupt.

In some cases, creditors may hold a meeting to obtain more information. If they request a meeting, you will be required to attend.

The Office of the Superintendent of Bankruptcy (OSB) may examine you under oath. They might ask about your conduct, causes of the bankruptcy, and inquire about your property and assets.

Complete the financial rehabilitation tasks

After declaring bankruptcy and selling your assets, you will be obligated to fulfill some duties to the court.

You must attend two financial counseling sessions. The goal is to teach you how to better manage your finances and help you understand the causes of your bankruptcy. These are mandatory.

Report your income and expenses

The Office of the Superintendent of Bankruptcy (OSB) determines how much income your family can maintain a reasonable standard of living.

Each month, you’ll need to submit pay stubs and report all monthly expenses.

Did you get a raise? Or are you picking up extra shifts?

This may be considered “surplus income.” You will need to submit this extra income to your trustee. They may keep a percentage of this extra income and distribute it to your creditors.

Reporting your income during bankruptcy

You’ll be required to report your income and expenses each month during bankruptcy. The bankruptcy trustee essentially takes control of your finances during this period.

The OSB determines how much income a family needs to maintain a reasonable standard of living. If your income exceeds this amount, you will have to pay certain amount to the trustee.

Life after bankruptcy

The actual process of claiming bankruptcy lasts between nine and 21 months for first-time bankrupts. Once all of your obligations have been met, all surplus income paid, non-exempt assets sold, and creditors notified, you can be “discharged from bankruptcy.”

This means you are released from the legal obligation to repay the debts you had as of the date you filed for bankruptcy.

However, you won’t have all your debts clear.

For example, you’ll still need to pay debts like alimony, child support, student loans (if you stopped being a student less than 7 years ago), court-ordered fines or penalties, or debts arising from fraud.

If you don’t qualify for an automatic discharge, your bankruptcy trustee will apply for a discharge hearing.

You will need to attend this hearing in person and the court will decide whether to discharge you and which kind of discharge.These include absolute, conditional, suspended, or none.

The impact of bankruptcy on your credit rating

As you know, bankruptcy carries a severe impact to your credit rating. You are assigned the lowest possible credit rating (credit score).

The information in your credit report that affects your credit score is usually removed after a certain period of time. The amount of time depends on the type of information and where you live.

Generally, it will be removed after six or seven years for a first bankruptcy, and after 14 years for subsequent bankruptcies.

Whether you can obtain credit after your discharge from bankruptcy will depend on your ability to convince lenders of your financial maturity and ability to repay the debt. There are no guarantees—no one is required to give you credit.

Will bankruptcy affect your spouse?

Your debts are your own. But if you and your spouse have a joint (co-signed) debt, then a creditor can pursue your spouse for repayment.

Only the portion of assets that you own is included in your bankruptcy. So, if you own assets jointly with your spouse, your portion may have to be sold and distributed to your creditors.

Someone who co-signed your loan

Anyone who co-signed a loan for you will still be responsible for making the loan payments after you go bankrupt.

Wages

Wages are not affected by bankruptcy; however, you will be required by the trustee to fill out a form listing any income.

If your income exceeds certain standards established by the Office of the Superintendent of Bankruptcy, you will be expected to make payments to your trustee for distribution to your creditors.

Student loan debt

There are programs available to help if you are experiencing financial difficulty because of student loans.

The Government of Canada’s Repayment Assistance Plan helps those with federal student loans pay back based on what they can reasonably afford.

A discharge from bankruptcy will release you from your obligation to repay your student loans if you filed for bankruptcy at least seven years after you stopped being a part-time or full-time student.

In the event that repaying the student loan will result in undue hardship, and provided you have made efforts to repay your loans, the court can reduce this period to five years.

FAQs about bankruptcy

“I heard it’s a myth that once you declare bankruptcy you are bankrupt for the next 7 years. It actually can take as little as 9 months to be discharged from bankruptcy.”

This is true, however what people mean when they say you are in bankruptcy for seven years is the amount of time it takes for the bankruptcy to be removed from your credit report and to repair your credit score enough so you can get credit cards, mortgages, car loans, etc again.

A person who declares bankruptcy is assigned the lowest possible credit score.

This bankruptcy notation will remain on your file for 6-14 years after you are discharged from bankruptcy, depending on the situation.

Whether you can obtain credit after your discharge from bankruptcy will depend on your ability to convince lenders of your financial maturity and ability to repay the debt.

“Will my spouse have to declare bankruptcy too?”

No. Your debts are your own. However, anyone who has co-signed on loans with you (be that person your spouse or anyone else) will be required to make the payments or risk having their own credit affected.

Similarly, if you co-own an asset, such as a house with another person, they will be affected in that you may be required to sell your portion. The trustee assigned to your case will need to be made aware of all joint assets so he or she may review them individually.

“Can I declare bankruptcy from my student loans?”

Yes, if you were a student more than 7 years ago. In the event that repaying the student loan will result in undue hardship, and provided you have made efforts to repay your loans, the court can reduce this period to five years.

However, due to the negative and long term consequences to your personal credit from filing bankruptcy, it is advisable to seek out one of the government’s repayment or interest relief assistance programs first.

“Will my wages be garnished forever to help repay the debts?”

No. You may be required to pay surplus income if you make over a certain threshold during your bankruptcy period, but once you are discharged your debts are dissolved.

“Is it free to declare bankruptcy?”

No. Several factors affect the cost, such as the size of your family, the assets you own, your expenses, the province you live in.

Typically, though, you pay via monthly contributions, surplus payments and assets you lose.

You will need to consult with a trustee to get an actual estimate based on your personal situation and where you live.

“Do all trustees work for the government?”

No trustee works for the government; they are independent businesses. This is why they require a base monthly fee.

“How much do I need to be in debt for before I can declare bankruptcy?”

You can declare bankruptcy with debt as small as $1000. You should file for bankruptcy when no other options are available to you, and the cost of bankruptcy is less than your total debt.

“How public will filing for bankruptcy be?”

Filing for bankruptcy is between you, your trustee and your creditors.

Your boss, best friends and even family members need not know if you choose not to tell them.

However, bankruptcy is a public record and anyone can pay a fee and search he bankruptcy records.

So what should you do next?

Even bankruptcy trustees will warn that filing bankruptcy is a drastic step. It should only be used as a last resort.

In fact, many people who begin looking to file bankruptcy end up filing a consumer proposal instead. This is a less drastic option.

Educate yourself about your options in Canada. We reccomend you read these 3 resources:

Begin with this true story of man in his 50s who lost everything. He is forced with a choice: bankruptcy or consumer proposal?

What is the difference between bankruptcy and consumer proposals? This simple guide explains it all.

An Ontario family is faced with bankruptcy. Here are the 6 steps they took to reduce debt from $57K down to $15K.

Bankruptcy laws by province

Alberta Bankruptcy Law

Read the Civil Enforcement Act for more information.

British Columbia Bankruptcy Law

Read the Court Order Enforcement Act and the Regulations for more information.

Manitoba Bankruptcy Law

Read the Executions Act and the Judgements Act for more information.

New Brunswick Bankruptcy Law

Read the Memorials and Executions Act.

Newfoundland and Labrador Bankruptcy Law

Read the Judgement Enforcement Act and the Regulations.

Nova Scotia Bankruptcy Law

Read the Judicature Act and the Regulations.

Ontario Bankruptcy Law

Read the Executions Act for more information.

Prince Edward Island Bankruptcy Law

Read the Judgment and Execution Act for more information.

Quebec Bankruptcy Law

Read the Code of Civil Procedure for more information.

Saskatchewan Bankruptcy Law

Read the Exemptions Act and the Farm Security Act.

Northwest Territories Bankruptcy Law

Read the Exemptions Act for more information.

Yukon Bankruptcy Law

Read the Exemptions Act for more information.

Nunavut Bankruptcy Law

Read the Exemptions Act for more information.