We believe that Canadians suffer unfairly from the complex language and confusing processes of the debt industry. This works in the favor of creditors, keeping Canadians deep in debt and robbing them of a chance at rebuilding their financial futures.

We use education and our industry expertise to guide Canadians to the solutions that best benefit them—not the solutions that benefit creditors.

4 Pillars has more reviews than any other competitor, with over 3,000 independent, unbiased reviews on TrustPilot. We’ve maintained a 4.9 average out of 5, ranking our services as 5-stars.

In the past, 'debt help' providers have used fear and technical confusion to mask the conflicts of interest that they face. These providers serve the interests of creditors, a fact they openly hide from the average Canadian without knowledge of the debt and credit industry.

Today, consumers demand choice, transparency, and want to make their own decisions, based on online research and peer-to-peer reviews. We are here to support that, remove any uncertainty and help you successfully navigate a confusing and scary process.

We believe consumers must have choice and transparency, to make the right decisions for their own financial futures. They must be presented with all the options available and fully understand the benefits and implications of each solution.

We use an independent review site called TrustPilot to give consumers a clear view into how our services work, the fees we charge, and the outcomes they can expect. TrustPilot is similar to Yelp or Tripadvisor, preventing companies from deleting or bullying clients into giving positive reviews.

We service 51 offices across Canada including offices in Toronto, Vancouver, Ottawa, Calgary, Montreal, Edmonton, Halifax, London, Winnipeg, Fredericton, St. John's, and Victoria, as well as towns and rural areas.

Our offices are part of our national network, giving us national strength as well as local expertise in different rural economies, housing markets, and the diverse situations of Canadians in debt.

Together, we’ve helped over 50,000 families regain financial control and drastically reduce their debt with $300 million of unmanageable consumer debt resolved every year.

4 Pillars also helped to create a community-based financial literacy program called EmpowerU.

EmpowerU offers participants’ financial literacy training with the opportunity to save money and have those funds matched 2:1 by the program. Participants attend a number of sessions covering financial topics such as budgeting, credit, goal setting, fraud prevention, debt reduction and investments.

EmpowerU is delivered through 11 non-profit organizations. The program brings together the financial strength of ATB Financial, United Way, City of Edmonton, The Home Program, EPCOR, Government of Alberta, and 4 Pillars with the research power of Civitas Consulting to better understand how people learn about money and the long-term benefits of financial literacy.

EmpowerU participants’ results:

At 4 Pillars, we’re experts in helping people navigate complex debt situations. We know the debt system, we know Canadians, we know the options and we ensure nothing is overlooked.

We also take a holistic approach to helping you, dealing with debt is only one part of the services, keeping you out of debt is equally as important.

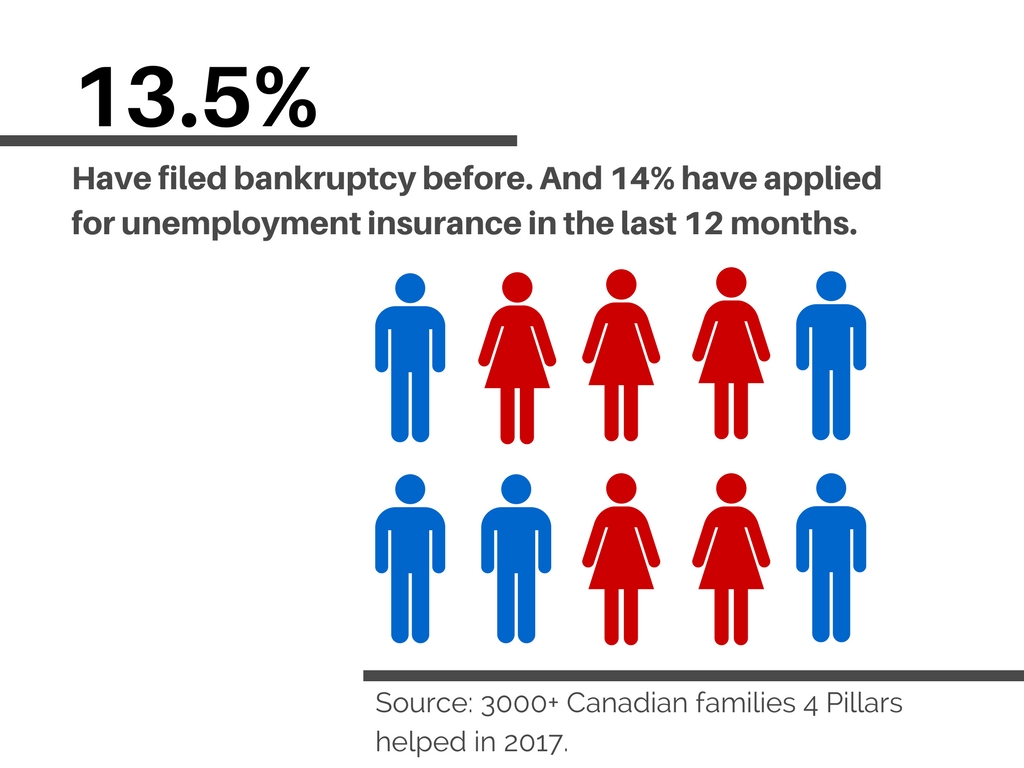

Without ongoing support you are left vulnerable for future financial failure, which is why it pains us to say 13.5% of the clients we help have been bankrupt before. They were not given the support and education they need to stay out of debt and abandoned by a system designed to help them.

The system has failed them.

We help you to not only choose the right option. But also to rebuild your long-term financial stability. The below diagram provides a very simplistic overview of the process we follow.

I had never carried consumer debt in my life and always paid my credit cards off. But circumstances left me with negative equity and negative cash flow properties, which quickly put me deep into debt. I had not considered bankruptcy as that was failure in my mind.

I met a consultant with 4 Pillars. He explained to me all my options. He also explained how the Trustee would file my proposal and how everything would work and the Trustees role etc. It was very clear to me who the Trustee was and that the proposal would be filed by the Trustee; and it was very clear who the 4 Pillars agent was and what their role was.

The 4 Pillars agent helped me through this confusing process and explained all my options. The agent was amazing, answered every call, every email, and every question I ever had and for many years. Once my proposal passed with the Trustee my 4 Pillars agent met with me and helped me understand how to avoid credit and debt problems in the future, and how to run a proper family budget. He also helped advise me on how to repair my credit so that I could have a good credit score very fast.

This good credit score enabled me to save a lot of money on mortgage financing by allowing me to reduce to a lower rate with my bank at renewal time.

Before I did the proposal, my rate had gone way up due to me having high debt, and having to borrow some high interest money off my house as a 2nd mortgage to try to pay unsecured debt. Had I met the 4 Pillars agent before this might not have even happened, but without knowing my options I did what I thought I could do to fix the debt problem.

I sought help from the bank first and they would not offer me a loan or any help or any solutions and told me to go bankrupt if I could not pay the debt. Distressed I talked to a mortgage broker and they offered me high interest high fee financing which I took; but was poor advice and it did not pay off the debt, and we ended up worse off than before thanks to the bad financing. But thanks to my 4 Pillars agentand the Trustee he introduced me to, we could deal with all my debt, and get me into better financing within a very short period (3 yrs.).

Here are the proven benefits I personally experienced by hiring 4 Pillars:

You can read thousands of similar stories from clients we’ve helped here.

4 Pillars does not charge a debt advisory fee and you will never be charged an upfront fee for the help you receive finding the most effective solution to deal with your debt.

Our role is an advocate for the debtor, placing their needs first and foremost, focused above all else on finding the most effective solutions to deal with their debt.

Through our network of independent consultants, you will be offered the opportunity to receive extended support and financial rehabilitation services to rebuild your financial future and help ensure you do not face future financial challenges. The Financial Advocacy and Wellness services provide comprehensive credit rebuilding and financial education. Our first step is ensuring you find the most effective way to deal with your debt. Now you can do this without worrying about upfront fees.

Once you find the most appropriate solution for your debt, we will then turn our attention to the most overlooked aspect of most debt solutions – your financial future. Our offices will help you rebuild your life by providing the tools, education and guidance needed to establish a stable financial future. After all, it’s the Canadian thing to do.

Here’s an interactive map and list of our 4 Pillar offices if you’re ready to take the next step. You can also give us your email here and we’ll route you to the closest office.

Loading Locator Software...

"The stress and worries are over. We are living again."

Actual client testimonial. Name removed to protect privacy.